Please Wait

This won't take a moment...

Explore all types of Ford van finance at Pentagon Ford. Buying a van should be simple and convenient so you won’t find any pushy sales or pressure in any of our dealerships. We aim to assist you in choosing the best van for your needs, whether for personal or business use.

Our SAF-approved team is on hand with expert advice and guidance on finding the best options when it comes to Ford van finance, covering PCP, HP, BCH, Finance Lease and Cash Plan.

With your choice of models and finance types, choosing the right offer for your business can be challenging.

We take the hard work out of finding the best Ford van finance for your next purchase. Our Specialist Automotive Finance approved team members guide you through the process so you get great value for money and monthly payments to suit your business.

Our panel of accredited lenders offers:

We offer five main types of Ford van finance for business:

Personal Contract Purchase (PCP) – Van finance with low monthly payments and an optional balloon payment at the end to purchase the vehicle.

Hire Purchase (HP) – Like a traditional loan, this covers the total price of the van plus interest and is split evenly over the agreement term. The van is yours after the final payment.

Business Contract Hire (BCH) – This type of lease agreement covers a specific period. After the final payment, the van is returned to the van leasing company.

Finance lease – This type of finance gives the option of terms similar to PCP or HP but is only available to business customers.

Cash Plan - Ideal if you have a cash deposit and don't want to be tied to monthly payments. You pay one Advance Payment and have an Optional Final Payment at the end of the term if you want to own the van with no monthly payments inbetween.

Discover more information on what type of van finance is best for you below.

Ford van PCP or Personal Contract Purchase is a flexible business van finance option. It works like a traditional loan. But, the payments are generally lower with an optional balloon payment at the end. The final price is based on the car’s anticipated value. So, when this is calculated, you can choose to keep the vehicle or return it to the finance company.

Low monthly costs – Payments are fixed and typically lower, which is ideal for all budgets. You can also spread them over a longer term or use a bigger deposit to reduce this even more.

Flexible terms – Everything from the loan term, deposit, and mileage are flexible to suit your needs.

End of lease options – Pay the balloon payment at the end of the lease for ownership of the van or hand it back – it’s up to you.

Regularly upgrade your van – If you need the latest van models for your business, this finance option allows you to trade in and get an upgrade every few years.

Protected from inflation and depreciation – There’s no need to worry about fluctuations in interest rates or depreciation, as your monthly costs are fixed and protected throughout the duration of your agreement.

Explore Personal Contract Purchase (PCP) Finance Here

If you’re considering owning a business van for longer than the loan agreement, hire purchase (HP) is a popular choice. This works like a traditional loan. First, the deposit you pay is deducted from the cash value. The remaining value plus interest is then split over the loan term. You can typically choose the term length, which varies from two to five years. After the final payment, you own the van.

Low monthly costs – Splitting the costs of the van equally offers an affordable and low-cost business finance solution.

Flexible terms – Select the deposit and agreement term to fit your needs.

No balloon payment – Pay a nominal fee at the end of the agreement, and the van is yours. No need to worry about a big balloon payment!

Low credit score friendly – HP is secured against the van. So, if you have a low credit score, it shouldn’t affect your chances of purchasing a new van.

No mileage cap – This finance covers the car’s total value, which means no mileage cap.

Protected from depreciation and inflation – Van monthly payments are a fixed amount. So, external market inflation or depreciation changes won’t spring any surprise charges on you.

BCH or Business Contract Hire is a type of finance that works like a lease agreement. There are fixed monthly costs, plus a mileage allowance over an agreed term. You return the van at the end of the contract, and there’s no option to purchase it. This is ideal for businesses looking to upgrade every few years.

Drive the latest models – Lease the latest vans for a few years, then hand them back and upgrade to your business.

Low monthly costs – BCH finance deals typically have lower monthly costs compared to other finance options, and they’re ideal for any budget.

Maintenance included – Take the hassle out of servicing and maintenance with finance deals that cover all this in the monthly cost.

Fixed costs – Monthly costs are fixed and protected against inflation and depreciation.

No reselling hassles – A BCP lease takes the stress away from reselling your van. Just hand it back and upgrade with ease.

A finance lease enables you to choose a new van for your business without making a capital investment. This type of van finance offers companies the choice of low monthly payments with a balloon payment at the end. Or instalments based on the entire cost of the vehicle, plus interest over an agreed term. However, these options are only available to business customers.

Fixed payments – Payment stays the same throughout the agreement, so no surprises.

Low initial costs and instant access – At the beginning of the finance lease, a small charge gives you immediate access to a van.

Claim back up to 100% VAT back – Reclaim between 50% and 100% of the VAT back on a commercial vehicle (for VAT-registered businesses).

Flexible payment terms – A flexible repayment option gives you scope to budget according to your cash flow.

Fixed or variable interest rates – Choose between fixed or variable interest rates to suit your business.

No mileage limit – Finance lease has no mileage limits, so there is no need to worry about mileage excess charges.

Receive 98% of the sale proceeds – You don’t own the van in this agreement, but if it’s sold to a third party at the end of the lease, you get 98% of the proceeds.

Cashplan only requires one advanced payment (all fees and interest included) so you can drive away with your new Ford commerical vehicle without having to worry about monthly payments. An optional final payment is avaliable to fully own the commercial vehicle.

No monthly payments - you won't be tied to monthly payments.

One required payment - all fees and interest included in one advanced payment.

Optional final payment- based off the future value of the vehicle allowing you to full own the vehicle at the end of your contract.

|

Business |

Hire Purchase | Finance Lease | Contract Hire | CashPlan | |

| Low initial deposit | OPTIONAL | OPTIONAL | OPTIONAL | YES | NO |

| Fixed monthly payments / rentals | YES | YES | YES | YES | NO |

| Ownership at the end of the agreement | OPTIONAL | YES | NO | NO | OPTIONAL |

| Postpone a 'balloon' payment to the end of the agreement | YES | NO | YES | NO | YES |

| Guaranteed Minimum Future Value | YES | NO | NO | NO | YES |

| No disposal uncertainty | YES | NO | NO | YES | YES |

| No depreciation risk | YES | NO | NO | YES | YES |

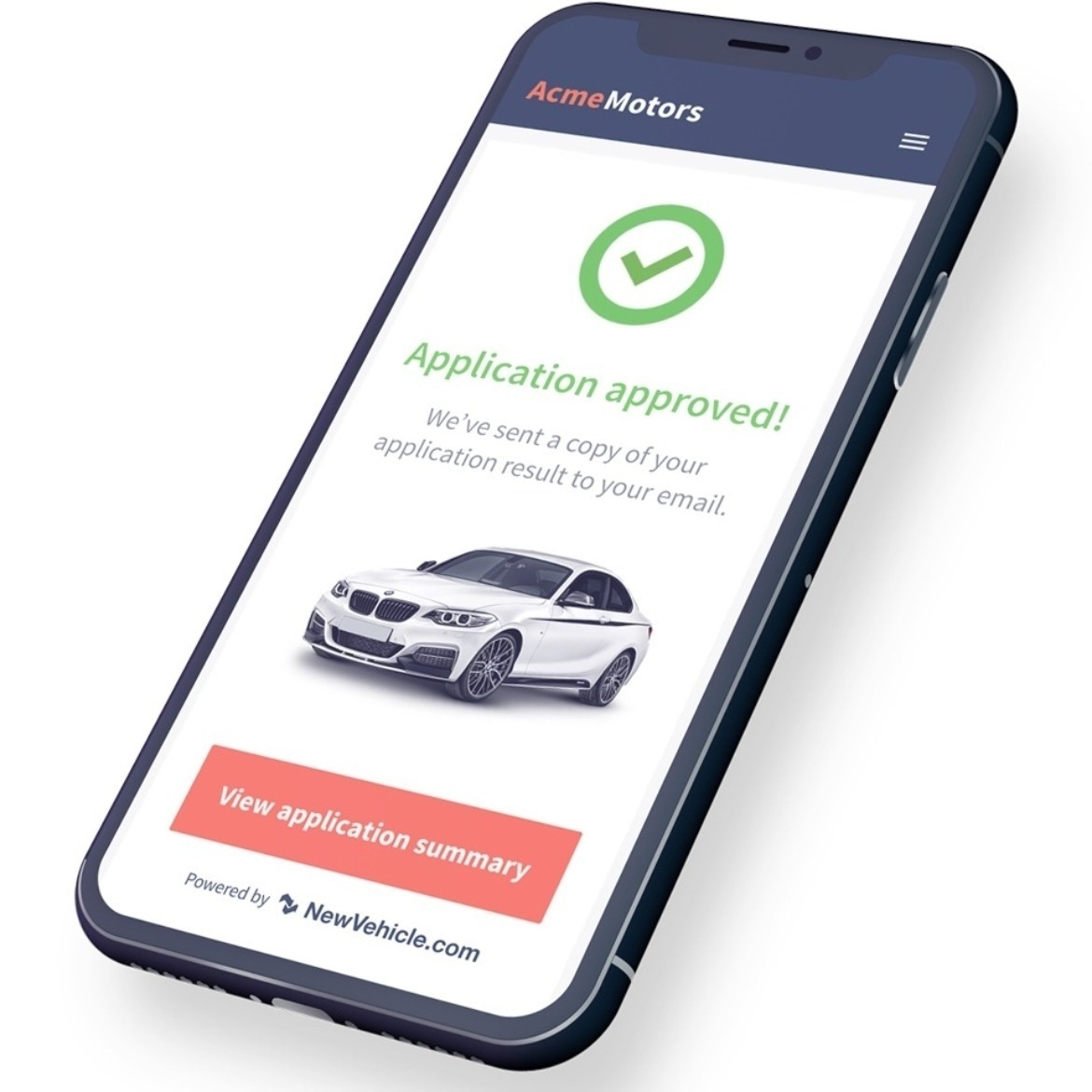

Looking for the best van finance deals? NewVehicle Car Finance Checker can help. This helpful tool has an intelligent decision-making system that indicates the likelihood of getting accepted for van finance. By checking numerous approved lenders, you get various offers to suit your circumstances and budget.

To check eligibility, enter the registration number and information for fast and free results. NewVehicle doesn’t affect your credit score or rating.

At Pentagon, all our dealerships have Specialist Automotive Finance Approved status. This recognises our commitment to professional standards and expert knowledge of motor finance.

Our customer-facing team members involved with the sale of finance have also passed a SAF competence test and can guide you through the available finance options.

Van finance companies utilise data to determine your eligibility and credit score. This information may also establish your interest rate and loan amount.

To find out more about credit ratings and the factors that affect them, visit our credit rating page.

Grimsby, North East Lincolnshire, DN31 2TG

Halesowen, West Midlands, B63 2RL

Pentagon Ford Warrington

Pentagon Ford Warrington

Warrington, Cheshire, WA2 7NY

This won't take a moment...

If you have a query relating to Discretionary Commission Agreements please email customer.care@pentagon-group.co.uk However, please note that if your query related to a purchase more that 7 years ago we will no longer hold any details due to our data retention policy.

This won't take a moment...